In the following, the subjective earnings value method will be compared to the DCF method (APV),

and an example will be given for both.

The data are from the initial scenario. An inflation and thus a growth of the net cash flow of 2%

is assumed, resulting in a perpetual growth rate at the planning horizon. The interest rate is

5% but must be taxed at 25% in private assets, so the net interest rate is 3.75%. No taxes are

due on the profit from the sale of the company.

The seller perceives the expectations about the company's development as subjectively certain.

Furthermore, he is risk-averse and wants to invest the proceeds from the sale of the company in

the bank.

Excursus: Risk can generally be taken into account either via the discount factor (risk premium

method) or via an adjustment in the cash flow (certainty equivalent method). Both can be

mathematically converted into each other (Terstege, 2023). It seems

sensible to me to capture it as an adjustment in the cash flow using various scenarios. This

simplifies a correct tax calculation, as it is based on earnings figures, is often non-linear,

and also includes allowances. In addition, one must explicitly think about the risk instead of

capturing it indirectly. In the above example, however, the seller sees his forecasts as

subjectively certain.

According to the earnings value method, a company value of 7700/(0.0375-0.02) =

440,000 monetary units results. To get the same net cash flow as through the company shares, the

seller must invest an amount of 440,000 monetary units in the bank.

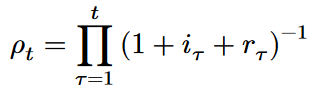

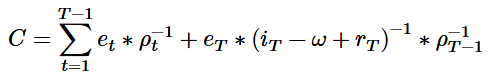

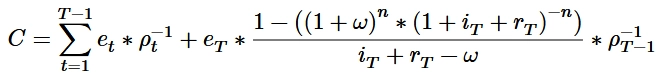

If the interest rate or cash flow fluctuates within the planning horizon, the more complicated

formula with period-specific discounting must be applied. As an example, it is applied here to

the case of the perpetual annuity with a growth rate:

Year 1: 7700 * (1+0.0375)^-1 = 7421.69

Year 2: 7854 * (1+0.0375)^-2 = 7296.50

Year 3: [8011.08/(0.0375-0.02)] * (1+0.0375)^-3 = 425,281.81

The sum also equals 440,000 monetary units.

Earnings Value Method as Base

| Description |

Year 1 |

Year 2 |

Year 3 |

Year... |

| Assets |

440,000 |

448,800 |

457,776 |

... |

| Gross Interest Income |

22,000 |

22,440 |

22,888.8 |

... |

| Taxes |

-5,500 |

-5,610 |

-5,722.2 |

... |

| Withdrawal |

-7,700 |

-7,854 |

-8,011.08 |

... |

Source: Own representation.

The calculations show that he receives the same cash flow each year as through his company. Since

the cash flow grows perpetually, the invested assets also increase in each period.

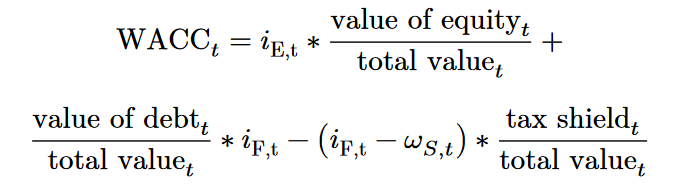

Now, the company value is calculated using the Equity approach, which is equivalent to the APV

approach from above. The data are taken from the above example of the APV approach and the

Equity approach with a perpetual growth rate of 2% in the steady state.

(8700-1000)/(0.1142857142857143-0.02) = 81,666.67 monetary units.

If the interest rate or the cash flow fluctuates within the planning horizon, the more

complicated formula with period-specific discounting must also be applied here. As an example,

it is applied here to the case of the perpetual annuity with a growth rate:

Year 1: (8700-1000) * (1+0.1142857142857143)^-1 = 6,910.26

Year 2: (8874-1020) * (1+0.1142857142857143)^-2 = 6,325.54

Year 3: [(9051.48-1040.4)/(0.1142857142857143-0.02)] * (1+0.1142857142857143)^-3 = 68,430.87

The sum also equals 81,666.67 monetary units.

The seller sold his company for this amount because he relied on an external consultant. However,

he does not invest his money in the capital market but in his local bank at 5% gross interest

because he is risk-averse. He tries to receive the same cash flow as through the company.

However, this is not possible for him, and his assets decrease year after year. The problem is

that the calculation was not made using the endogenous marginal interest rates of the party

involved. A value was determined for a fictitious investor in the capital markets. The external

consultant simply relied on the textbook formulas known to him without taking into account the

individual situation of his client.

DCF Method

| Description |

Year 1 |

Year 2 |

Year 3 |

Year... |

| Assets |

81,666.67 |

77,029.16 |

72,063.76 |

... |

| Gross Interest Income |

4,083.33 |

3,851.46 |

3,603.19 |

... |

| Taxes |

-1,020.83 |

-962.86 |

-900.8 |

... |

| Withdrawal |

-7,700 |

-7,854 |

-8,011.08 |

... |

Source: Own representation.

The DCF method is based on capital market theoretical explanatory models that do not correspond

to real conditions. In the above example, the alternative investment of the bank was the

marginal interest rate (endogenous marginal interest rate) and not an interest rate derived from

the CAPM model. The extreme example shows that the decision value of the party involved only

coincidentally matches the company value determined using a DCF method.

The deviations of the company value according to the DCF method can occur both above and below

compared to the earnings value method or functional business valuation.