The capitalised earnings method according to IDW S 1 is described in particular in margin nos. 102-123. A

distinction is made between a subjective and an objectified capitalised earnings method. The subjective form

is described in margin no. 123. In addition to this subjective form, there is the objectified capitalised

earnings method (margin nos. 114-122), which is described below.

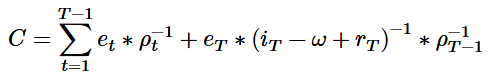

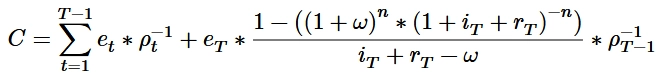

The procedure of the objectified capitalised earnings method according to IDW S 1 is simplified as follows:

- A planning period is defined (e.g., 5 years), and then a perpetuity (or a present value) is applied.

- Planned balance sheets and profit and loss statements are prepared to determine the sustainable profit.

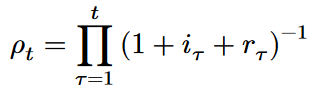

- The calculation interest rate is determined and derived from a model called Tax-CAPM (Brennan, 1970). Specifically, a risk-free base interest rate is determined,

which is then supplemented by a risk premium (market risk premium * beta factor). This interest rate is

then discounted with a (typified) personalized tax rate. Furthermore, the interest rate at the planning

horizon is corrected by a growth factor.

- The net cash flow is discounted using the calculated calculation interest rate.

Planning Period

- Base Interest Rate +

- Market Risk Premium * Beta Factor =

- Gross Interest Rate

- Gross Interest Rate * (1 - Tax Rate) =

- Net Interest Rate

At the planning horizon (perpetual)

- Base interest rate +

- Market risk premium * beta factor =

- Gross interest rate

- Gross interest rate * (1 – tax rate) –

- Growth rate =

- Net interest rate

The procedure is similar to the subjective capitalised earnings method (in accordance with IDW S 1). The

difference is that the starting point is not the individual calculation interest rate, but an objectified

interest rate consisting of base rate + market risk premium * beta factor. Although the value is therefore

more “objective”, it is irrelevant for the valuation subject. Detailed and accurate criticism of why the

objectified capitalised earnings value method according to IDW S 1 should not be used for decision-making

purposes can be found in Matschke and Brösel (2013).

This will be illustrated here using an example. The gross cash flow for the company is 12000 MU and 8400 MU

after tax (30%). The cash flow trends in line with inflation of 2%.

In the subjective capitalised earnings method (in accordance with IDW S 1), the interest rate is set

at 5% before and after taxes of (25%) 3.75%. This is what he actually gets from his bank. The value is

8400/(0.0375-0.02) = 480000 MU. As the example shows, the sale price compensates for the lost cash flow

through the interest income. In this example, risks are not taken into account due to subjectively certain

expectations (expectancy value).

Table 6: Company Value Calculation Capitalised Earnings Method (Subjective)

| Name |

Year 1 |

Year 2 |

Year 3 |

Year... |

| Capital |

480000 |

489600 |

499392 |

... |

| Interest Revenue (Gross) |

24000 |

24480 |

24969.6 |

... |

| Taxes |

-6000 |

-6120 |

-6242.4 |

... |

| Withdrawal |

-8400 |

-8568 |

-8739.36 |

... |

Source: own representation.

For the capitalised earnings method according to IDW S 1 in its objectified form, a base interest

rate of 4% and a market risk premium of 4.5% apply. These data, as well as the beta factor of 1.05, are

normally derived from the TAX-CAPM model. Added together and adjusted for taxes, the interest rate is

(0.04+0.045*1.05)*(1-0.25) = 6.54%.

This results in a value of 8400/(0.0654-0.02) = 184869.36 MU.

The objectified capitalised earnings value method in accordance with IDW S 1 implies that the alternative

investment is in the same risk class with the same level of debt.

Table 7: Company Value Calculation Capitalised Earnings Method According to IDW

S 1 (Objectified)

| Name |

Year 1 |

Year 2 |

Year 3 |

Year... |

| Capital |

184869.36 |

182939.75 |

180774.64 |

... |

| Interest Revenue (Gross) |

9243.47 |

9146.99 |

9038.73 |

... |

| Taxes |

-2310.87 |

-2286.75 |

-2259.68 |

... |

| Withdrawal |

-8400 |

-8568 |

-8739.36 |

... |

Source: own representation.

However, the valuation subject invests its money with the house bank and attempts to obtain the same

withdrawal flow as before the sale. His capital decreases every year because the interest income is not

sufficient to compensate the former cash flow. The reason is that the objectified capitalised earnings

method according to IDW S 1, like the DCF method, does

not consider the subject’s real alternative investment, but a fictitious investment on the capital market.

Decisions should therefore not be based on the objectified capitalised earnings method according to IDW S 1.

However, it does provide a good basis for argumentation, as it is widely used and respected in Germany.

It may be criticised that the figures in the example are arbitrarily chosen, but it nevertheless shows the

following very well. The business value, which was calculated using the objectified capitalised earnings

method according to IDW S 1 and not the subjective capitalised earnings method (according to IDW S 1),

coincides at best with the decision value by chance. Wrong decisions happen frequently. Discrepancies are

possible both upwards and downwards.

For more information on a business valuation and an appraisal according to

IDW S 1, you can find the link here.