Each of the methods mentioned above for business valuation aims to discount the cash flow (future

earnings value) (para. 85). According to para. 87, it is generally assumed that the company has an

unlimited life, although in individual cases it may be assumed to have a limited life. As an example, a

quarry is mentioned.

Non-operating assets are assumed to be liquidated immediately, provided that holding them is not more

advantageous.

Risk is to be considered in business valuation (para. 88), whereby this can be done by a deduction

in the cash flow or a risk premium on the interest rate (para. 89). Mathematically, both can be transformed

into each other (Terstege, 2023).

In paras. 90-92, it becomes apparent that the IDW strongly prefers the risk surcharge and favors a

derivation from the CAPM model (Sharpe, 1964; Lintner,

1965; Mossin, 1966) or Tax-CAPM (Brennan, 1970).

Further elaborations are given in paras. 114-122. For a critique of the risk surcharge on the discount rate

and the CAPM model, refer to Hering (2017) and Hering

(2021).

With regard to CAPM and Tax-CAPM, it should also be emphasized that in the capital structure, the value of

the debts and not the book value of the debts is to be considered (para. 100). The capital structure is

significant for deriving the risk using the beta factor.

In the objectified business valuation, the discount rate in practice consists of a maturity-equivalent

basic interest rate (quasi risk-free rate) and a risk premium (paras. 114-122).

In determining the subjective decision value, individual assumptions are decisive (para. 123). Both the

cash flow and the discount rate must consider income taxes in equity methods (para. 93). The consideration

of income taxes also applies to DCF methods (para. 139). For formulas related to net interest rates, refer

to Schneeloch et al. (2020).

In the planning period, growth is explicitly to be considered in the cash flow and implicitly at the

planning horizon through a growth rate (paras. 94-98). Generally, nominal cash values and interest rates are

used.

A formal presentation of the present value calculation, on which both the capitalised earnings method and

the various DCF methods are based, follows.

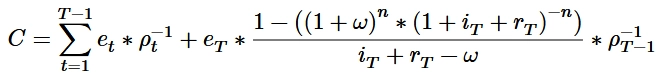

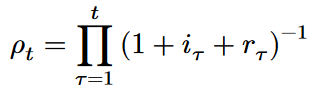

Formulas for Discount Factor

Here, the formula for the discount factor is presented. ρ stands for the discount factor, t for the

respective year, τ is a running variable for time, i for the interest rate, and r for the risk. If the risk

is considered in the cash flow by a deduction, no risk premium may be applied to the interest rate.

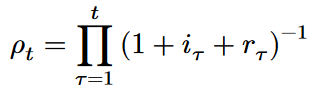

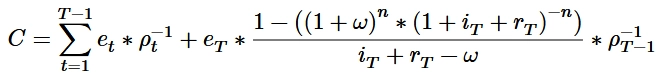

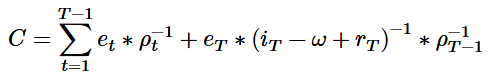

Formula for Business Valuation with Unlimited Life

Para. 86 assumes that a company has an unlimited life. This is represented by the following formula. The

first part shows the discounting in the planning period, and the second part stands for the annuity at the

planning horizon. C stands for the capital value, t for the respective year, T for the planning period, e

for the cash flow, ω for the growth rate.

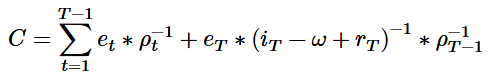

Formula for Business Valuation with Limited Life

Para. 87 describes that some companies have a limited life. This becomes visible through the following

formula. Instead of the perpetual annuity at the planning horizon, a present value is used. n stands for the

years.