Do you need a real estate valuation in the form of a market valuation report from an independent valuer? You’ve come to the right place. I will be happy to provide you with a market appraisal in the form of a short or full appraisal in accordance with § 194 BauGB and ImmoWertV.

These legal standards are used in particular for courts and banks.

I am also glad to review existing market valuation reports for you.

In addition to the statutory standards, I also carry out real estate valuations using other methods such as the capitalised earnings method (original, IDW S1), the DCF method or the functional valuation theory.

These methods, especially the functional valuation theory, should be used for investment purposes.

The assessment of the physical condition of the real estate is carried out by an expert you or I trust. It is also common practice in business valuation to use specialised personnel, particularly from the company management and accounting departments, to assess the company.

In the context of business valuations, real estate valuations are often part of the calculation of the liquidation value, which can be understood as the lower value limit.

The offer for real estate valuations and market valuation reports is also aimed in particular at civil engineers for co-operation.

Receive a high-quality market value report for your property in accordance with ImmoWertV or other valuation methods. The findings of a building expert from a site inspection are included.

Receive a brief market value report for your property in accordance with ImmoWertV or other valuation methods. The findings of a building surveyor from a site inspection are included.

Have your report checked for errors, inconsistencies and manipulations. In addition to the correct application of the valuation method, its suitability can also be discussed.

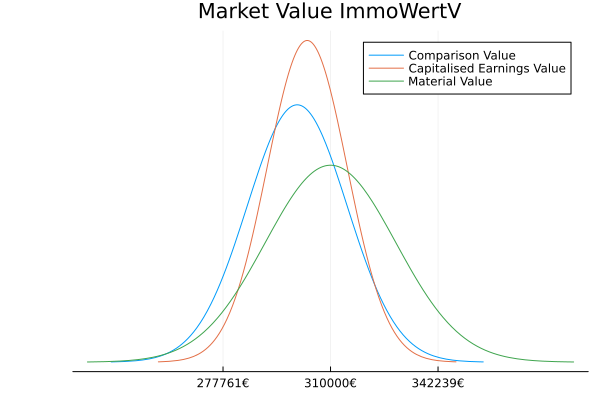

§ Section 194 BauGB stipulates a so-called market-orientated and objective valuation. A precise description of how this is to be carried out can be found in the ImmoWertV. It essentially describes how to obtain and adjust the data basis and how to calculate three valuation methods: the comparative value method, the capitalised earnings method and the material value method.

As the maths in ImmoWertV corresponds to that of a perfect capital market, all three methods should correspond.

Plain and simple: The comparison value method according to §§ 24-26 ImmoWertV calculates the expected market price of a real estate on the basis of a univariate (comparison prices) or multivariate estimate (comparison factors) and includes special property-specific adjustments.

The provisional comparative value in accordance with section 24(2) ImmoWertV can be calculated on two bases.

The first method can be understood as a univariate estimator (statistics) and the latter as a multivariate estimator such as a fixed effects (FE) estimator.

After calculating the preliminary comparison value, corrections (special object-specific) adjustments must still be made. The comparison value is calculated using the following formula:

comparison value = market-adjusted comparison value ± floor adjustment ± building adjustment

Plain and simple: The capitalised earnings method in accordance with sections 27-34 ImmoWertV calculates the expected market price of a real estate on the basis of the expected net income using a calculation interest rate called the property interest rate, taking into account the remaining useful life of the property, the land value and special property-specific adjustments.

The capitalised earnings method according to ImmoWertV has three forms: the general capitalised earnings method according to § 28 ImmoWertV, the simplified capitalised earnings method according to § 29 ImmoWertV and the periodic capitalised earnings method according to ImmoWertV § 30. All three methods can be mathematically converted into one another. (The formulae are defined in § 34 ImmoWertV).

Firstly, the net income according to 31 para. 1 ImmoWertV is described. The net income results from the gross rent in accordance with 31 Para. 2 ImmoWertV less the operating costs (§ 32 ImmoWertV). The operating costs are made up of the administration costs, the maintenance costs, the expected loss of rent and the operating costs in accordance with Section 556 BGB. A description can be found in Appendix 3 ImmoWertV. It is important to adjust the data to the consumer price index (§ 9 ImmoWertV para. 1).

The calculation interest rate for the capitalised earnings method in accordance with the ImmoWertV is called the property interest rate. This property interest rate is to be determined on a property-specific basis in accordance with § 33 ImmoWertV and must be applied consistently in the respective calculation (§§ 28-29, 30 Para. 3 ImmoWertV).

In the general capitalised earnings method in accordance with Section 28 ImmoWertV, the provisional capitalised earnings value of the buildings is calculated from the capitalised net income (Sections 31-32 ImmoWertV) less the interest on the land over the remaining useful life.

In the simplified capitalised earnings method in accordance with section 29 ImmoWertV, the provisional capitalised earnings value is calculated from the capitalised net income over the remaining useful life and the discounted land value on the valuation date after the remaining useful life.

The periodic capitalised earnings method in accordance with § 30 ImmoWertV allows the discounting of a period-specific net income for a maximum observation period of 10 years (§ 30 Para. 2 ImmoWertV) and a present value of a net income for the remaining useful life after the observation period. In addition, at the end of the remaining useful life, the land value is discounted to the valuation date.

In accordance with section 27(3) ImmoWertV, the provisional capitalised earnings value equals the market-adjusted capitalised earnings value.

This market-adjusted capitalised earnings value is again subject to special property-specific adjustments.

capitalised earnings value = market-adjusted capitalised earnings value ± land adjustment ± building adjustment

Plain and simple: The material value method according to §§ 35-39 ImmoWertV calculates the expected market price of a real estate on the basis of the normal production costs, taking into account the land value, an age reduction factor, a regional factor, a material value factor and special property-specific adjustments.

The provisional material value in accordance with Section 35 ImmoWertV consists of three parts:

To calculate the provisional material value of the buildings, the normal production costs must first be determined in accordance with Annex 4 ImmoWertV. It is essential that a distinction is made between net and gross floor area (Annex 4 I. 2. ImmoWertV). The cost parameters are to be determined in accordance with Annex 4 II. ImmoWertV. Essentially, standardised standard production costs are specified for various building types and characteristics.

These standard production costs must be adjusted to the construction price index or a similar index. Furthermore, an age value reduction factor (§ 38 ImmoWertV) must be taken into account. This is essentially determined by depreciation, but can also be influenced by modernisation (Annex 2 ImmoWertV).

The procedure for the provisional material value of external structures and other facilities is similar to that for buildings (Section 37 ImmoWertV).

This provisional material value (of the property) must still be adjusted to a regional factor (Section 36 (1) ImmoWertV).

This provisional material value is to be multiplied by a property-specific adjusted material value factor §§ 35 Para. 3, 39 ImmoWertV. A market adjustment with premiums and discounts can also be made (§ 35 Para. 3 ImmoWertV). In my opinion, these should only take place after the multiplication.

The calculated value is called the market-adjusted provisional material value (of the property).

Now a correction must be made to the respective property (§35 Para. 4 ImmoWertV). This is done as follows:

material value = provisional market-adjusted material value ± land adjustment ± building adjustment

In addition to the real estate valuation in accordance with ImmoWertV, reference has already been made above to the original capitalised earnings method, the capitalised earnings method in accordance with IDW S1, the DCF method and the functional valuation theory. A brief description of all four methods can be found under business valuation. You can find a description of all methods called the capitalised earnings method here. The DCF method is described in detail under the link provided.

Explanations of the real estate value in the cases of letting vs. selling and renting vs. acquiring can be found on the linked page.